hp calculators

HP 12C Depreciation

hp calculators - 3 - HP 12C Depreciation - Version 1.0

To calculate the depreciation after entering these values, key in the number of the year for which the depreciation is to

be calculated and press fV, fÝ or f#. The amount of depreciation is calculated and shown in the

display. To see the remaining depreciable value (book value minus salvage value) press ~.

Practice solving depreciation problems

Example 1: The R&D department of a crystal refinement company spent $28,000 for new equipment for the digital

spectrometer lab. The expected life for this equipment is 12 years, and the salvage value is $2,500.

Calculate the declining balance depreciation for the fifth and eighth years and compare the values to the

straight-line fixed depreciation. Use the DB method with a 2× weight (200%) related to the SL.

Solution: Load the TVM registers with the relevant values and calculate the depreciation for the fifth and eighth years

using the DB method:

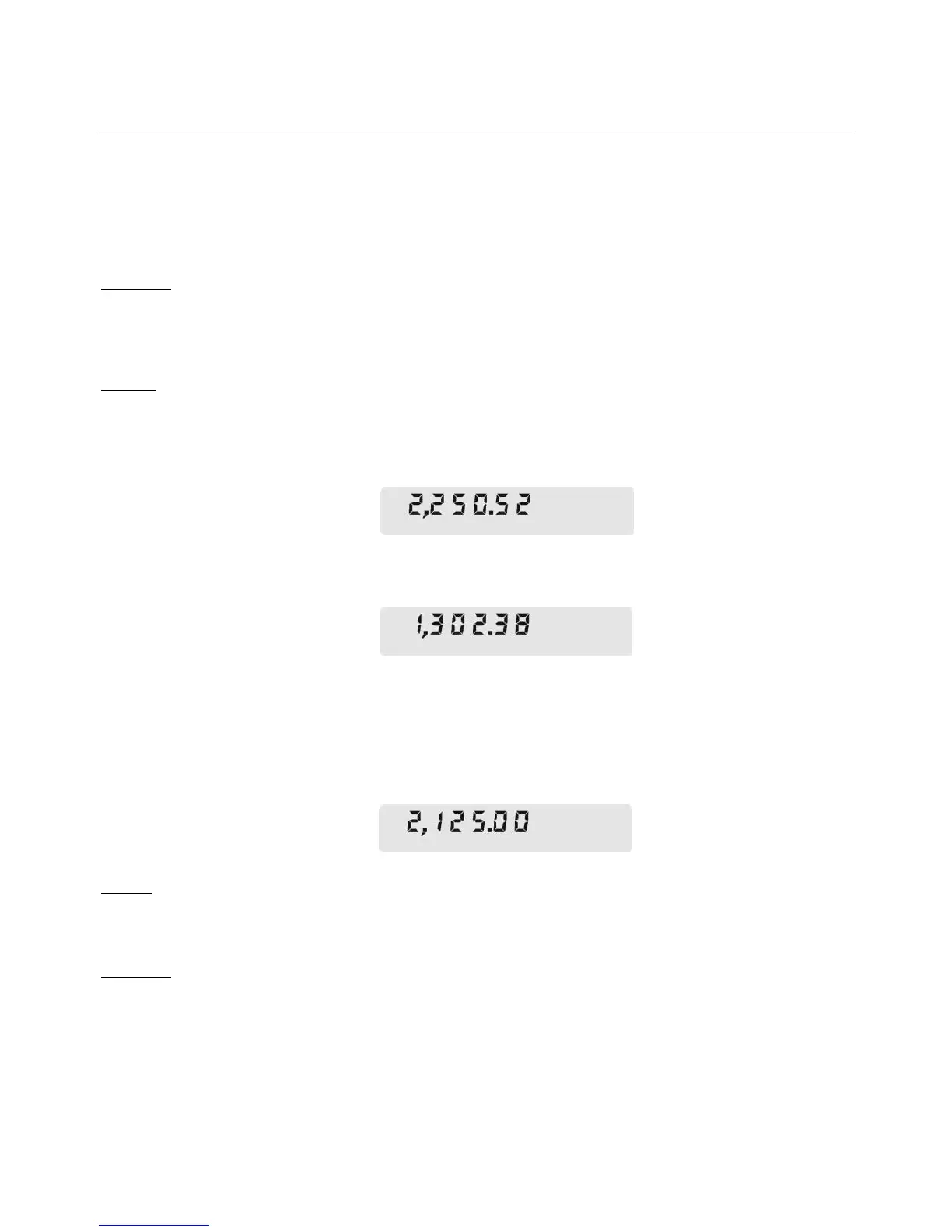

28000 $ 2500 M 200 ¼ 12 w 5 f#

Figure 2

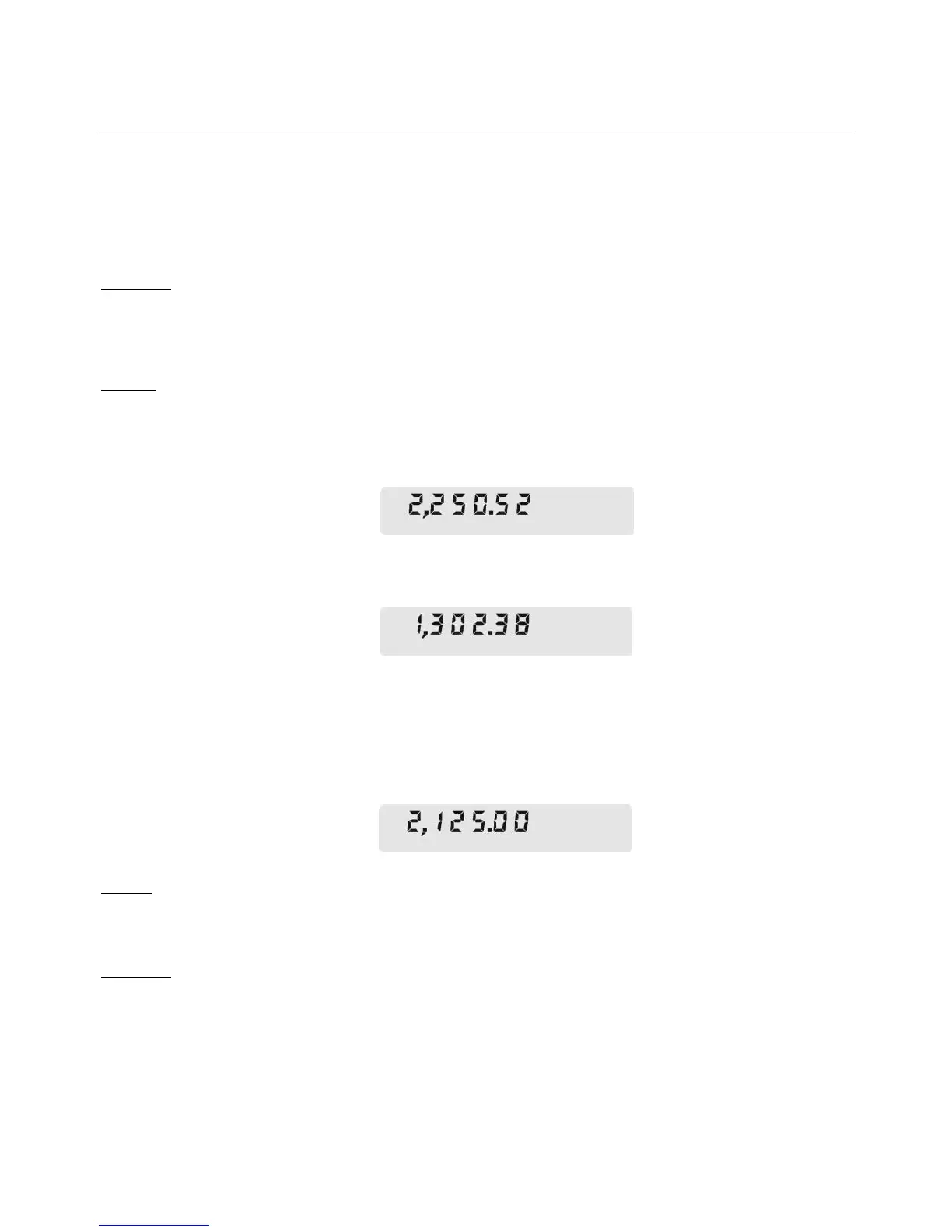

8 f#

Figure 3

Keep the TVM registers with previous values and calculate the depreciation using the SL method. As the

straight-line method returns the same depreciation amount for each valid period, it is enough to calculate it

for the first year.

1 fV

Figure 4

Answer: The amount of depreciation with 2× weighted DB method for the 5th year is $2,250.52 and $1,302.38 for

the 8th year. With the same figures, the annual amount of depreciation calculated with the SL method is

$2,125.

Example 2: Professional video equipment bought for $15,000 has a useful life of 8 years with a salvage value of

$1,100. Using the SOYD method, find the amount of depreciation for the fourth year.

Loading...

Loading...