hp calculators

HP 12C Net Present Value

hp calculators - 2 - HP 12C Net Present Value - Version 1.0

Cash Flow and NPV calculations

Cash flow analysis is an extension of the basic TVM concepts applied to compound interest problems when payments

occur in regular periods and do not have the same value. Any financial investment can be represented as an initial

investment of money and a series of cash flows that occur in regular periods of time. Each flow of money can be positive

(received) or negative (paid out) and considered as a cash flow. Common cash flow problems usually involve the

calculation of the Internal Rate of Return (IRR) or the Net Present Value (NPV).

The NPV expresses the amount of money resulting from the summation of the initial investment (CF

0

) and the present

value of each anticipated cash flow (CF

j

) calculated to the time of the initial investment. The IRR is the discounted rate

applied to all future cash flows that cause NPV = 0.

The expression that calculates the Net Present Value is:

()() ()

j

j

2

2

1

1

0

111 i

CF

i

CF

i

CF

CFNPV

+

++

+

+

+

+= L

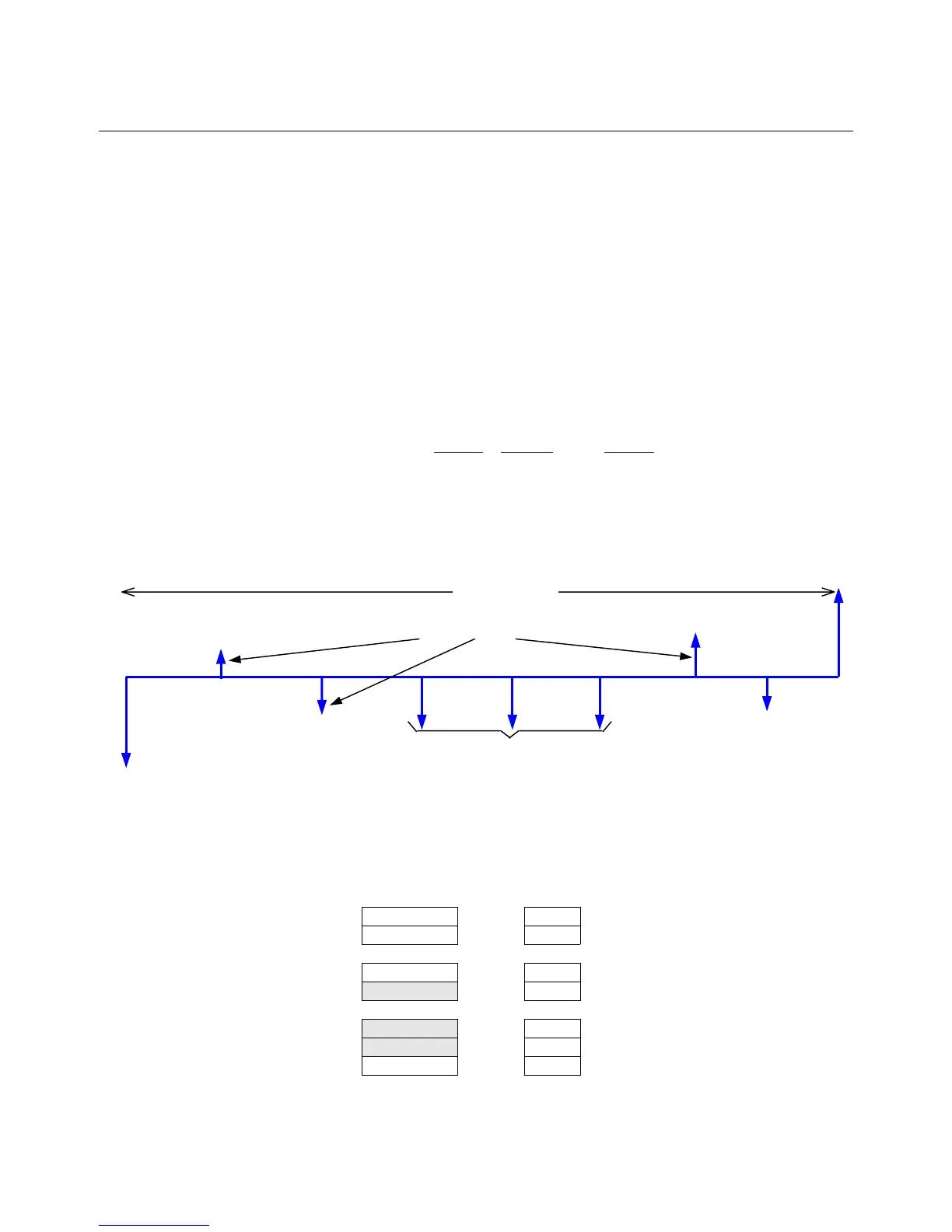

Figure 1

Cash flow diagrams

The cash flow diagram in Figure 1 illustrates one of the many possible situations that can be handled by the HP12C.

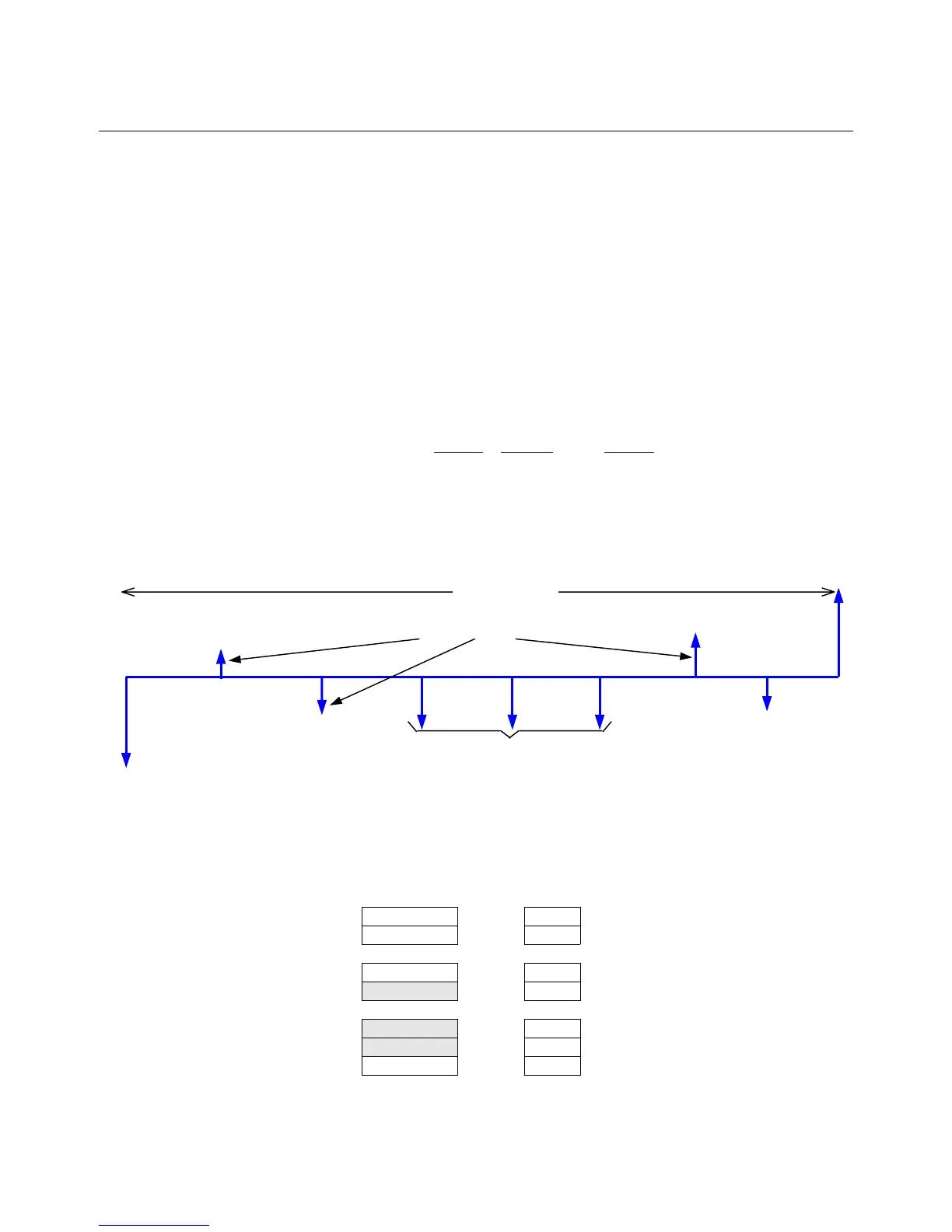

Figure 2

The HP12C cash flow approach

In the HP12C each cash flow amount is stored in its corresponding register in memory. For each cash flow amount there

is a related register to store the number of consecutive occurrences of this amount. This approach is shown below:

Registers Cash flow N

j

R

0

CF

0

N

0

R

1

CF

1

N

1

...

... ...

R

6

CF

6

N

6

R

7

CF

7

N

7

...

... ...

R

.8

CF

18

N

18

R

.9

CF

19

N

19

FV

CF

20

N

20

Figure 3

gJ Initial Cash Flow

gK Last Cash Flow

gK Intermediate Cash Flow

ga Number of consecutive occurrences of CFj

Composition Period

Loading...

Loading...