Bonds48

The Bond Menu

Before you enter the Bond menu, be sure to verify the date format is set appropriately for your

problem. The default setting is mm.ddyyyy, but it can be set for dd.mmyyyy. The range of

acceptable dates is October 15, 1582 to December 31, 9999. Bond day counts (360/365)

and annual or semiannual coupon payment schedules may be set from either the Mode menu

or the Bond menu. For more information on setting the preferences in the Mode Menu, see

the section titled, The Mode menu: Setting Preferences in Chapter 1.

To open the Bond menu, press B.

Press

< or > repeatedly to scroll through the items shown in Figure 1.

To change the value of the displayed item, key in a number or a date and press I.

Once you have entered all known data, Press < or > repeatedly to scroll to an

unknown item, and press

= to calculate it.

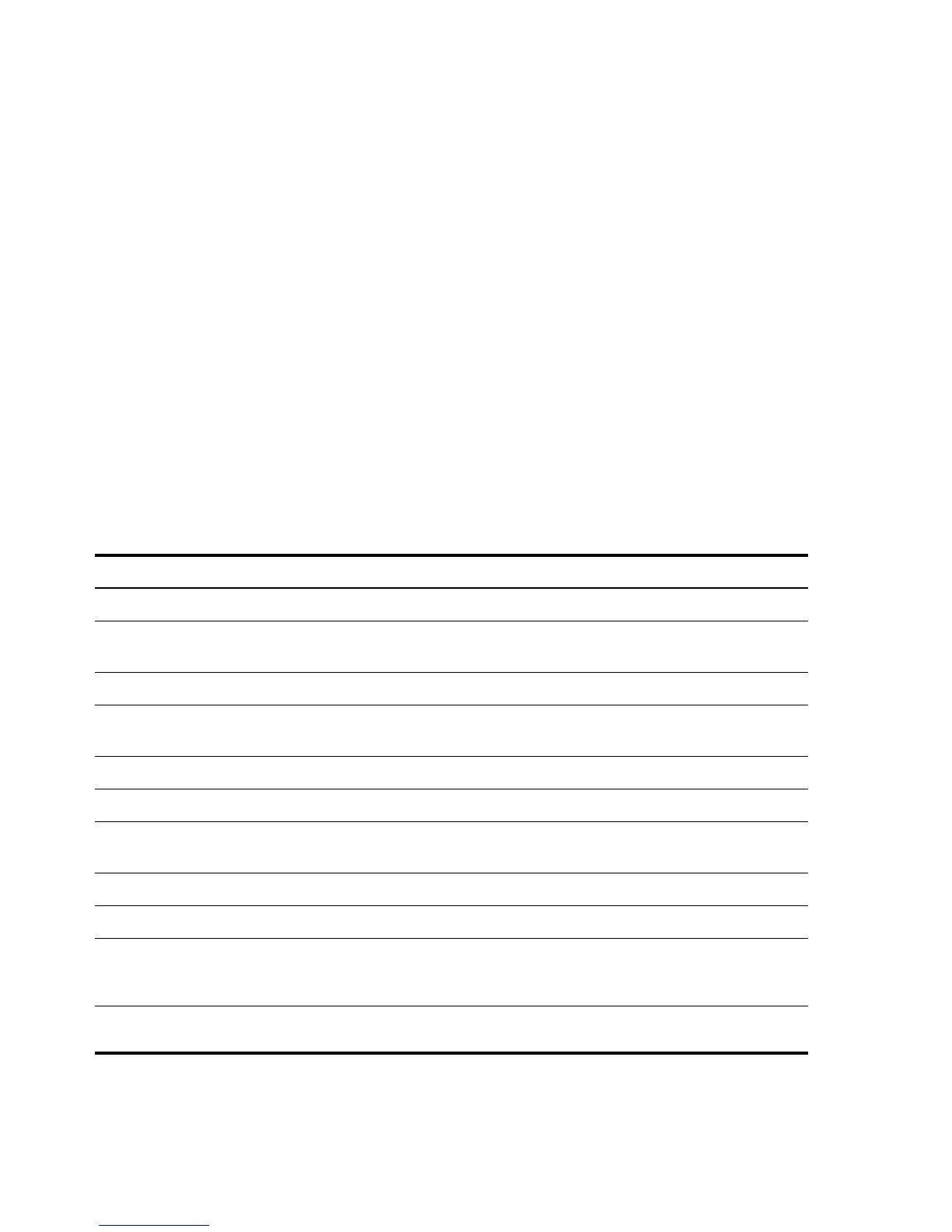

Table 6-1 lists the items in the Bond menu.

*Does not apply to the HP 20b.

Table 6-1 Bond Menu Items

Variable Description

Settlement Date Settlement date. Displays the current settlement date. Note: input only.

Maturity Date Maturity date or call date. The call date must coincide with a coupon date. Displays the current

maturity. Note: input only.

CPN% Coupon rate stored as an annual %. Note: input only.

Call Call value. Default is set for a call price per 100.00 face value. A bond at maturity has a call

value of 100% of its face value. Note: input only.

Yield% Yield% to maturity or yield% to call date for given price. Note: input/output.

Price Price per 100.00 face value for a given yield. Note: input/output.

Accrued Interest accrued from the last coupon or payment date until the settlement date for a given yield.

Note: this item is Read-only.

Mod. Duration* Modified duration for the bond. This is a measure of bond price sensitivity to yield changes.

Macaulay D.* Macaulay Duration for the bond. This is a measure of bond price sensitivity to yield changes.

Actual/Cal.360 Actual (365-day calendar) or Cal.360 (30-day month/360-day year calendar). Press

I to toggle between these options.

Annual/Semiannual

Bond coupon (payment) frequency. Press

I to toggle between these options.

Loading...

Loading...