70

Example 2: Determine the yield of this security; settlement date June 25,

1980; maturity date September 10, 1980; price $99.45; redemption value

$101.33. Assume 360 day basis.

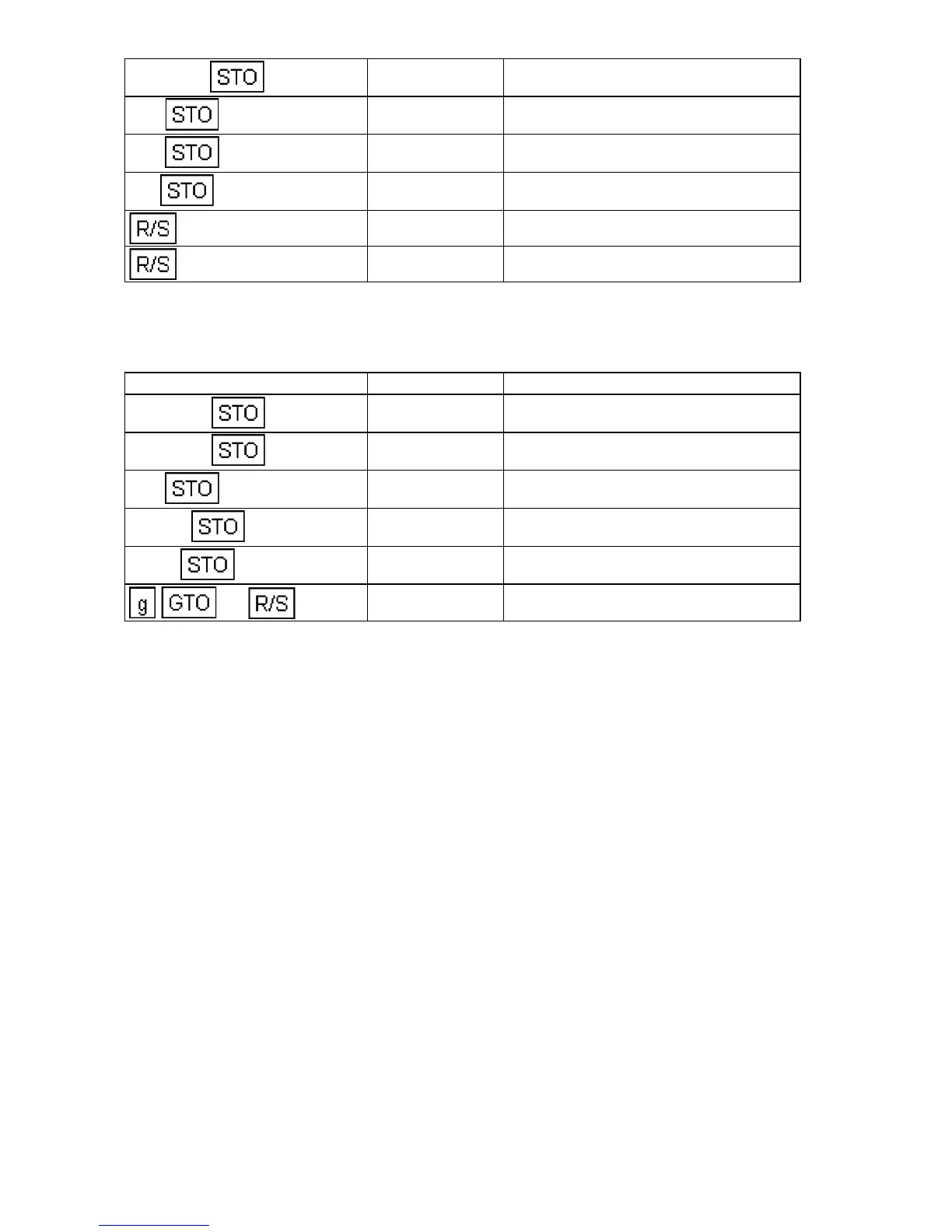

3.211981 2

3.21 Maturity dtae.

360 3

360.00 360 day basis.

100 4

100.00 Redemption value per $100.

7.8 5

7.80 Discount rate.

96.45 Price.

8.09 Yield.

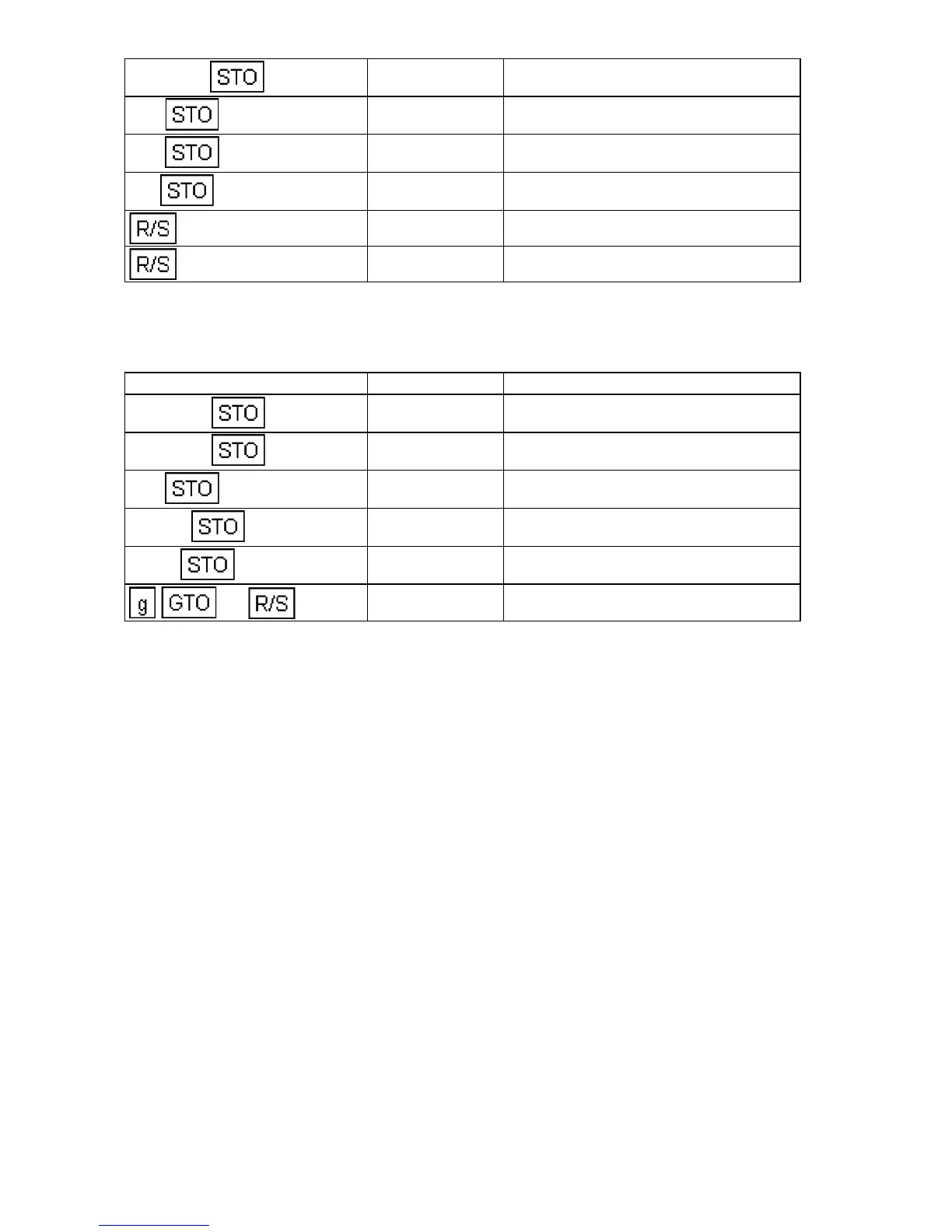

Keystrokes Display

6.251980 1

6.25 Settlement date.

9.101980 2

9.10 Maturity dtae.

360 3

360.00 360 day basis.

101.33 4

101.33 Redemption value per $100.

99.45 5

99.45 Price.

15

8.84 Yield.

Loading...

Loading...