36

To use the Cash Register’s basic function

To preset taxable statuses to departments

By default, Dept. 05 through 12 are preset as tax status 1 and the rest of the

departments are non-tax states. By presetting taxable statuses to departments,

the Cash Register performs tax calculations with the rate you have set on pages

18 and 19 “To set the language, date, time, and tax rates”.

Presetting taxable statuses to departments

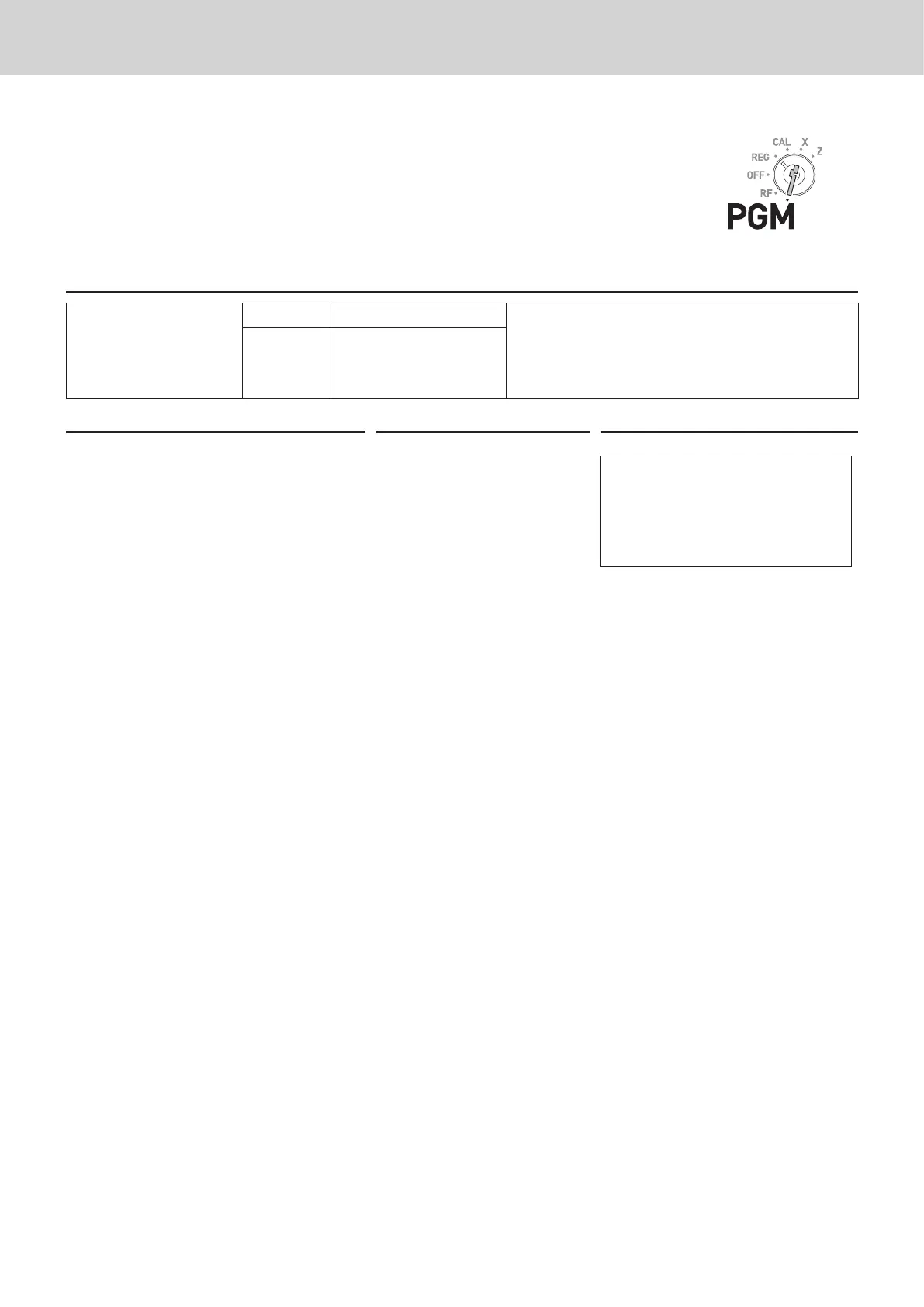

Sample Operation

Tax status

Dept. 05 Tax status 2 (10%) Presetting tax status 2 (10%) to Dept. 05 and tax

status 3 (15%) to Dept. 06. Ten and fteen percent

tax rates have been set in “To set the language,

date, time, and tax rates” on pages 18 and 19

as an example.

Dept. 06 Tax status 3 (15%)

Step Operation Printout

1 Turn the Mode switch to PGM

position and press Z and o

keys. Now, the Cash Register is in

the setup mode.

Zo

01−21−2015 16:10

P

01 000018

DEPT05

T2

DEPT06

T3

2 Pressing ~ key repeatedly chang-

es the tax status indication as; T/S1

→ T/S2→ T/S1 & T/S2 → T/S3 → T/

S1 & T/S3 → T/S2 & T/S3 → ALL →

NON TAX. Select the tax status you

wish to set. In this example, T/S2.

~ ~

3 Press corresponding Dept. key. In

this example, Dept. 05. If you wish

to set the same tax status to an-

other department, press the Dept.

key consecutively.

∞

4 Press ~ key twice. The tax status

indication changes to T/S3. After

then, press corresponding Dept.

key.

~~ §

5 Press o key to complete the

setting.

o

Loading...

Loading...