88

Appendix

Tax table programming

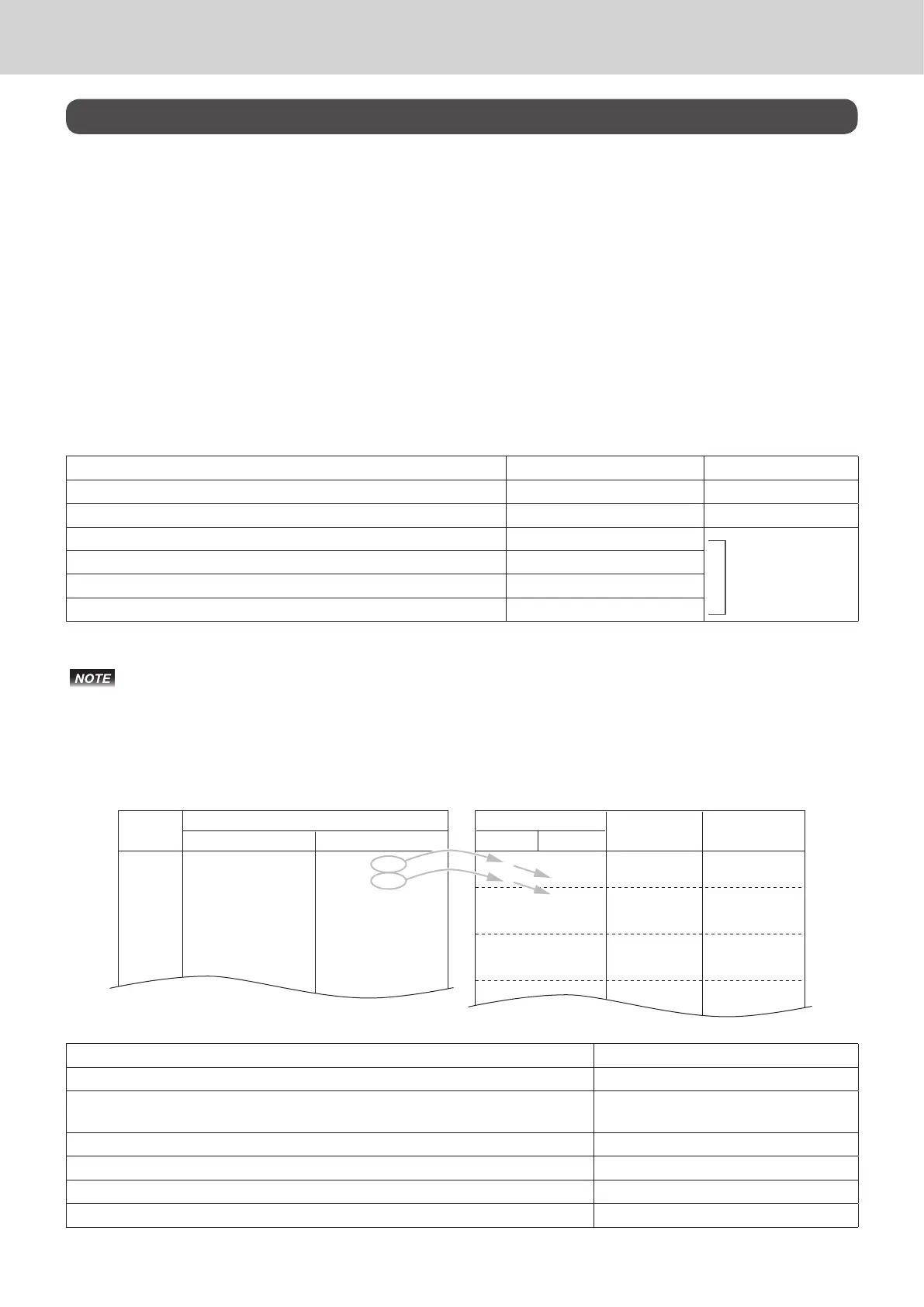

Programming U.S.tax tables

Before you can program a U.S. tax table, you must rst calculate the program data. The partial tax table

shown below is for a tax rate of 7.0%. A tax amount is applied for each price range, which is dened by a

low end minimum break point. If you subtract each maximum break point from the next lower maximum

break point, you should soon be able to see certain patterns. In a cyclic pattern, the differences in maxi-

mum breakpoints form a regularly repeating cycle. A pattern which does not t the cyclic pattern is called

non-cyclic pattern.

Though rate, it is conceivable that you can nd that subtracting maximum breakpoints results in an one

big non-cyclic pattern. In this case, you won’t be able to use automatic tax calculation, and must enter

the tax for each transaction manually or use a tax rate.

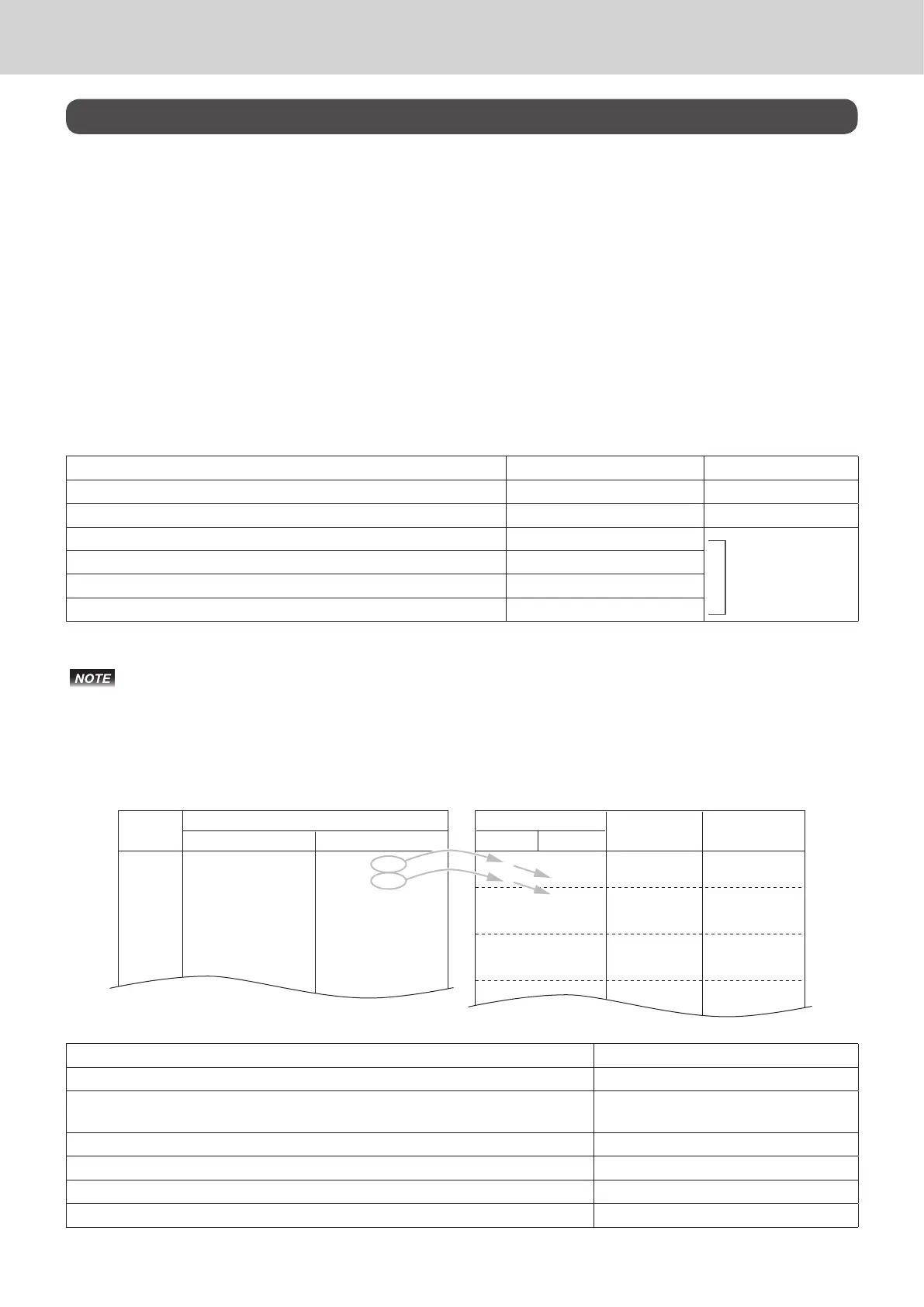

Example 1: Add-on rate tax

Preparation

Tax rate (2-digit for integer + 4-digit for decimal) 7.0%

Tax table maximum value (“0” means unlimited) 0 (no limitation)

Rounding/tax table system code 5002 (Round off)

Sum of a cyclic pattern 0

No need to enter.

Number of values in each cyclic pattern 0

Number of values in each non-cyclic pattern 0

Actual value of difference of the non-cyclic and cyclic values 0 0

Programming procedure:

Refer to page 71 “To set tax table” for setting tax table.

Example 2: Without rate tax

Preparation

–

–

–

–

–

–

–

–

=

=

=

=

=

=

=

=

=

10

24

41

58

74

91

108

124

0

10

24

41

58

74

91

108

124

10

14

17

17

16

17

17

16

17

17

Max. break point

Upper

Difference

Pattern

Non-cyclic

Cyclic

Cyclic

Lower

$ .00

.01

.02

.03

.04

.05

.06

.07

$ .01

.11

.25

.42

.59

.75

.92

1.09

$ .10

.24

.41

.58

.74

.91

1.08

1.24

TAX

(6%)

Price range

Min. break point Max. break point

Tax rate (2-digit for integer + 4-digit for decimal) 0% (Table only)

Maximum table amount (“0” means unlimited) 0 (Table only)

Rounding system (A) and tax system of add-in or add-on (B) codes (see pages

60 and 61)

01 (Table only)

Sum of a cyclic pattern 50 (17 + 17 + 16)

Number of values in each cyclic pattern 3

Sum of non-cyclic values 24 (10 + 14)

Actual value of difference of the non-cyclic and cyclic values 10, 14, 17, 17, 16

Loading...

Loading...