20070201

7-4 Cash Flow (Investment Appraisal)

This calculator uses the discounted cash fl ow (DCF) method to perform investment appraisal

by totalling cash fl ow for a fi xed period. This calculator can perform the following four types of

investment appraisal.

• Net present value (

NPV )

• Net future value (

NFV )

• Internal rate of return (

IRR )

• Payback period* (

PBP )

* The payback period (

PBP ) can also be called the “discounted payback period” ( DPP ).

When the annual interest rate ( I %) is zero, the PBP is called the “simple payback period”

(

SPP ).

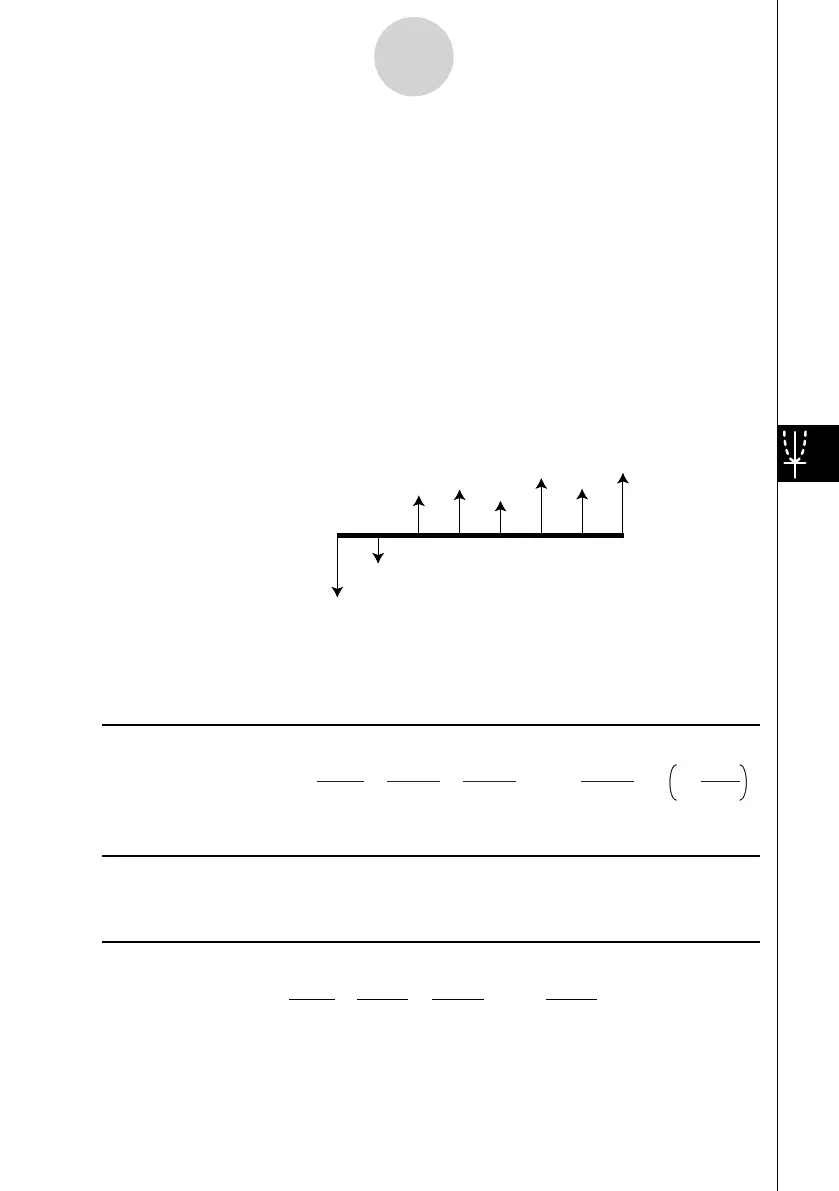

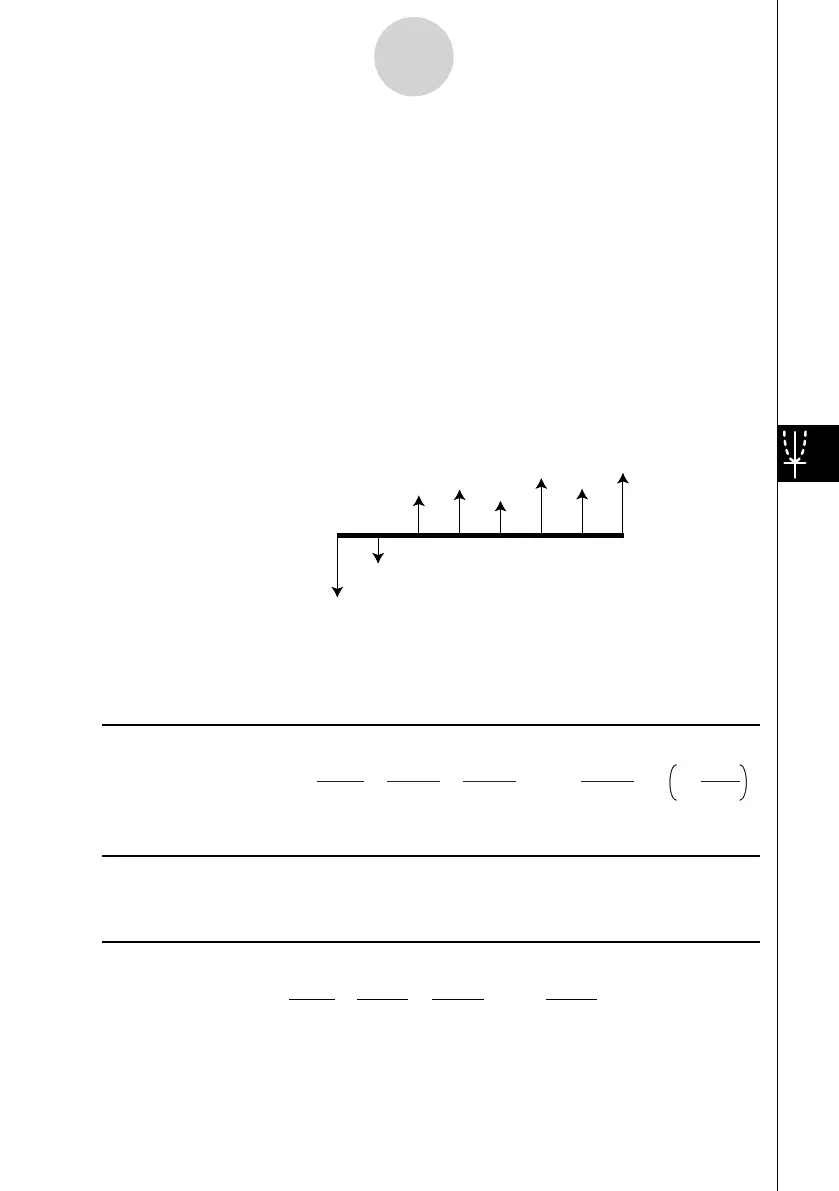

A cash fl ow diagram like the one shown below helps to visualize the movement of funds.

With this graph, the initial investment amount is represented by CF 0 . The cash fl ow one year

later is shown by CF 1 , two years later by CF 2 , and so on.

Investment appraisal can be used to clearly determine whether an investment is realizing

profi ts that were originally targeted.

u NPV

n : natural number up to 254

u NFV

u IRR

In this formula, NPV = 0, and the value of IRR is equivalent to i × 100. It should be noted,

however, that minute fractional values tend to accumulate during the subsequent calculations

performed automatically by the calculator, so NPV never actually reaches exactly zero. IRR

becomes more accurate the closer that NPV approaches to zero.

CF

0

CF

1

CF

2

CF

3

CF

4

CF

5

CF

6

CF

7

CF

0

CF

1

CF

2

CF

3

CF

4

CF

5

CF

6

CF

7

NPV = CF0 + + + + … +

(1+ i)

CF

1

(1+ i)

2

CF2

(1+ i)

3

CF3

(1+ i)

n

CFn

i =

100

I %

NPV = CF0 + + + + … +

(1+ i)

CF

1

(1+ i)

2

CF2

(1+ i)

3

CF3

(1+ i)

n

CFn

i =

100

I %

NFV = NPV × (1 + i )

n

NFV = NPV × (1 + i )

n

0 = CF

0

+ + + + … +

(1+ i)

CF

1

(1+ i)

2

CF

2

(1+ i)

3

CF

3

(1+ i)

n

CF

n

0 = CF

0

+ + + + … +

(1+ i)

CF

1

(1+ i)

2

CF

2

(1+ i)

3

CF

3

(1+ i)

n

CF

n

7-4-1

Cash Flow (Investment Appraisal)

Loading...

Loading...