136 Finance app

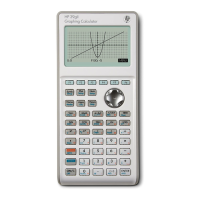

1. Start the Finance App. Use the arrow keys to highlight

P/YR. Verify that P/YR = 12 and End is set for

payments occurring at the end of the compounding

period.

2. Enter the known TVM

variables from the

example as shown in the

figure.

3. Highlight PMT and press to obtain a payment

of -$948.10.

4. To determine the balloon payment or future value (FV)

for the mortgage after 10 years, enter 120 for N,

highlight FV, and press . This calculates the

future value of the loan as -$127,164.19.

NOTE

The negative values indicate payments from the

homeowner.

Calculating Amortizations

Amortization calculations, which also use the TVM

variables, determine the amounts applied towards

principal and interest in a payment, or a series of

payments.

To calculate amortizations:

1. Start the Finance Solver as indicated at the beginning

of this section.

2. Set the following TVM variables:

• Number of payments per year (P/YR)

• Payment at beginning or end of periods

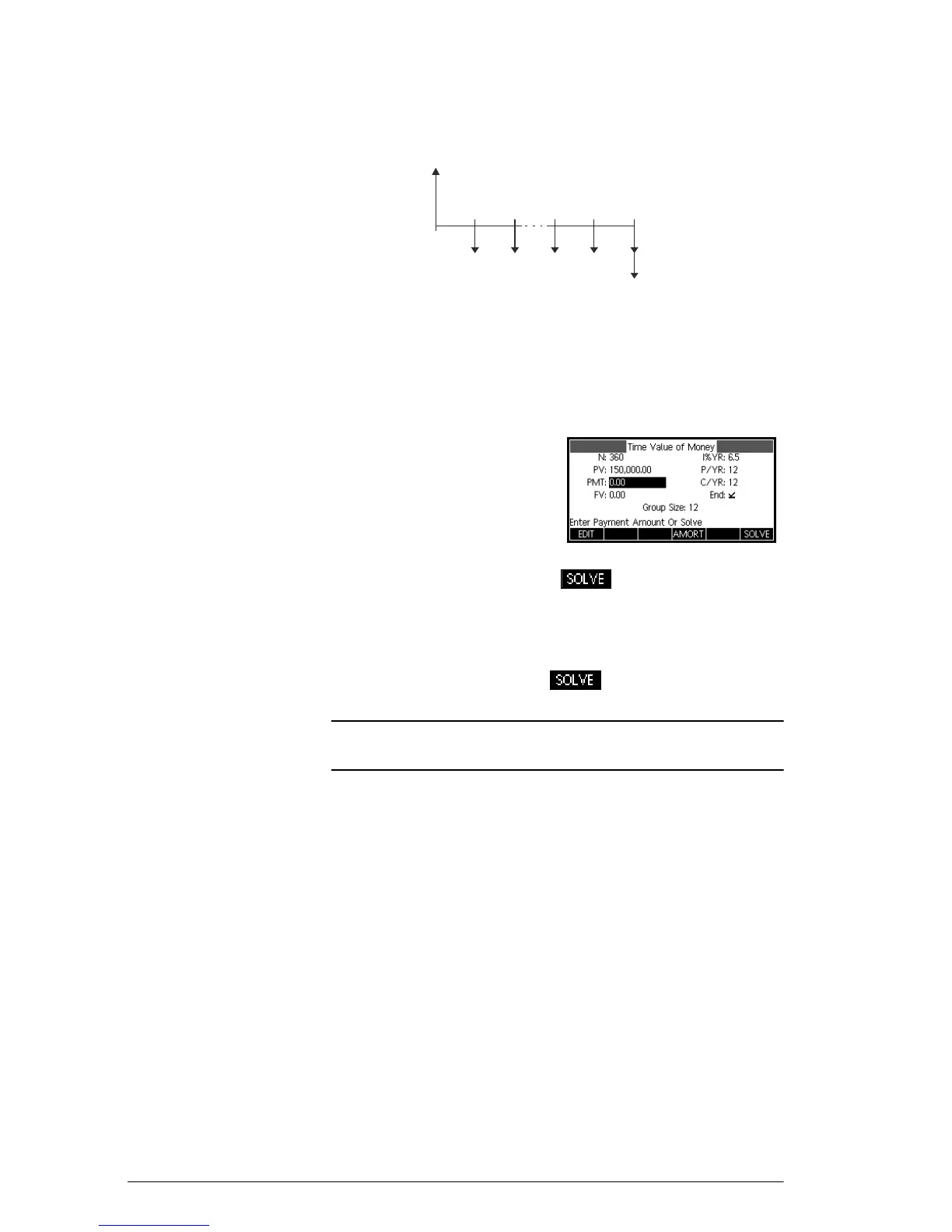

PV = $150,000

1

2

59

60

l%YR = 6.5

N = 30 x 12 = 360 (for PMT)

N = 10 x 12 = 120 (for balloon payment)

P/YR = 12; End mode

PMT = ?

Balloon payment,

FV = ?

Loading...

Loading...